Inflation in Malaysia are now everyone concern as we approach what appears to be a turmoil 2023 in terms of global economy and possibly local economy and inflation is the current hot topic along with the rising food cost here in Malaysia. It’s been predicted that inflation will be between 2.8% to 3.3% in 2023 with a possible OPR hike in the first quarter of 2023 itself. Prediction comes into view that the OPR rate will be as per pre-Covid era which was 3.25%.

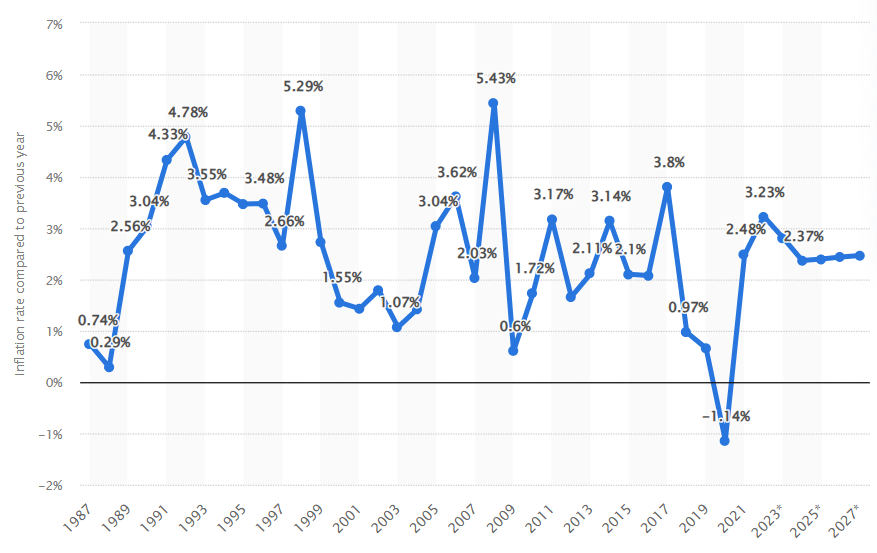

https://www.statista.com/statistics/319033/inflation-rate-in-malaysia/

Malaysia ended 2022 with a 3.3% inflation rate and most predict a downtrend in 2023 with inflation capping around 2.8% to 3% by end 2023. Above is the inflation rate in Statista webside along with the projection until 2027. And just as they predicted the inflation rate of 2023, it too predicts two more OPR hike in 2023. The inflation rate will ultimately be decided by Malaysia economic growth and ringgit strength hence what the new government will be doing to tackle all this will be crucial as always. So, all eyes are on them when they table the Budget 2023 this coming February.

Hence, we maintain our expectation for Bank Negara to raise the OPR by another 25 bps in January and March this year, bringing the OPR to 3.25%

Quoting HLIB Research from Starbiz, Wednesday 4th January 2023.

With that prediction from most experts, we’ll be expecting our monthly installments for loans to increase as well as the banks will adjust the BLR and BFR rate coinciding with the new OPR rates. Though inflation will remain high, Bank Negara have stated they are not expecting recession to hit Malaysia in 2023 in line with improvements to its economic growth. Bank Negara governor says inflation to remain high, but Malaysia not expecting recession in 2023- Malay Mail

This remains to be seen as the Internation Monetary Fund or IMF have warned that third of the global economy will be in recession in 2023 due to factors like war in Ukraine, resurgence of COVID in China and higher interest rates among some factors contributing to this outlook. Here’s hoping for a better 2023 than what it’s painted to be. Article here for Third of world in recession this year, IMF head warns