The scheduled, 3rd Monetary Policy Commitee (MPC) Meeting of 2023, have been completed and it appears as some has expected but sooner is the inevitable rising of the OPR by 0.25%. The Overnight Policy Rate or OPR now have risen to 3%. So, expect your loans to now raise hence need to pay more. Refer… Continue reading Overnight Policy Rate (OPR) -Raised

Category: Finances & Invest

Finances relates to what steps I did to try to achieve the illusive financial freedom by investing, learning and maximize my investment for a better and stable return.

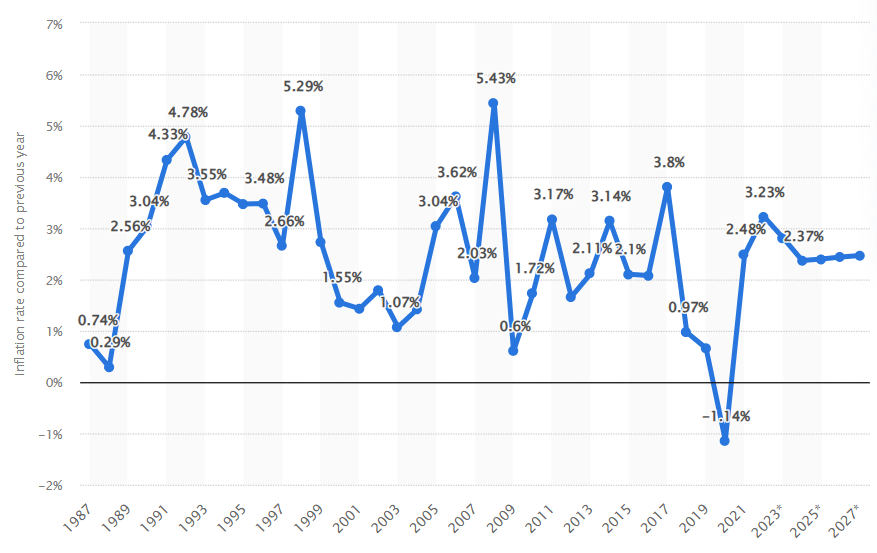

Inflation, OPR Forecast, Gloomy 2023.

Inflation in Malaysia are now everyone concern as we approach what appears to be a turmoil 2023 in terms of global economy and possibly local economy and inflation is the current hot topic along with the rising food cost here in Malaysia. It's been predicted that inflation will be between 2.8% to 3.3% in 2023… Continue reading Inflation, OPR Forecast, Gloomy 2023.

Monetary Policy Committee (MPC) Meeting Schedule – 2023

With the looming predicted recession of 2023 coming, Malaysia among other countries is wary of such recession would impact the country or SEA in 2023. With some reports stating the country will manage to avert it due to the broad and diversity domestic economy, make no mistake that we are facing a challenging 2023 and… Continue reading Monetary Policy Committee (MPC) Meeting Schedule – 2023

BNM Clarifies On Moratorium Interest

Referring to my blog entry: Moratorium Agreement Changes, so apparently the Bank Negara Malaysia (BNM) have maintained their approach that no changes were actually made to the 6-month Moratorium Hire Purchase Loan and Fixed-rate Islamic loans when it first started. The news that the interest will be included in the moratorium caused an uproar among… Continue reading BNM Clarifies On Moratorium Interest

Moratorium Agreement Changes

Well its too good to be true and there's going to be a U-Turn on the cards for Bank Negara Malaysia (BNM) in regards to the moratorium first announced during the early stages of the MCO/PKP. Apparently starting tomorrow, there's going to be changes done to the deferment for banks related to hire purchase loan… Continue reading Moratorium Agreement Changes

Economy Impact Due To COVID-19

Now that we are heading for the phase 4 of the MCO/PKP, this is something I haven't look at until now. The economic / business impact that COVID-19 has cause in Malaysia. There are several industry that's hard hit along with the SMEs that's severly hit by the lockdowns. Business are close, customers are nowhere… Continue reading Economy Impact Due To COVID-19

OPR To Face Further Cuts?

With the MCO/PKP well in place until May 12th and the forecast of the country economy let alone the global economy, there's been prediction that the OPR will be further reduced in the upcoming Monetary Policy Committee (MPC) meeting that is scheduled for 5th May on Tuesday. Now I am all in for the OPR… Continue reading OPR To Face Further Cuts?

Bantuan Prihatin Nasional (BPN) Register Through IRB.

Those who are qualified for the financial assistance (BPN) are required to register with Inland Revenue Board (IRB). However those who have previously registered for Bantuan Sara Hidup (BSH) need not register. Bantuan Prihatin Nasional (BPN) would be made in two phases – at end of April and May 2020. For those who have yet… Continue reading Bantuan Prihatin Nasional (BPN) Register Through IRB.

So To Defer Or Not To Defer For 6 Months?

So now that Bank Negara is allowing a 6-month grace for loan payments for both individuals and SME but me, well I'm focus more on the individual one's. So which loans they are talking about? It will have to be the two big ones which will be mortgages and hire purchase or it's cute name… Continue reading So To Defer Or Not To Defer For 6 Months?

Bank Negara Six-month Grace Period For Loans

So now further initiatives are being done to ease the burden in terms of finance due to COVID-19 here in Malaysia. Due to the outbreak many lives are affected as some depend on the income they gain daily for example restaurants, roadside stalls, freelancers, contractors, part time workers and pretty much everyone who have to… Continue reading Bank Negara Six-month Grace Period For Loans